Highest tax payer in India contributes to the most of development of country. Direct taxes are taxes that are levied on the income or profits of individuals or organizations, such as income tax, corporate tax, capital gains tax, etc.

Direct taxes are an important source of revenue for the government, as they reflect the economic activity and prosperity of the country.

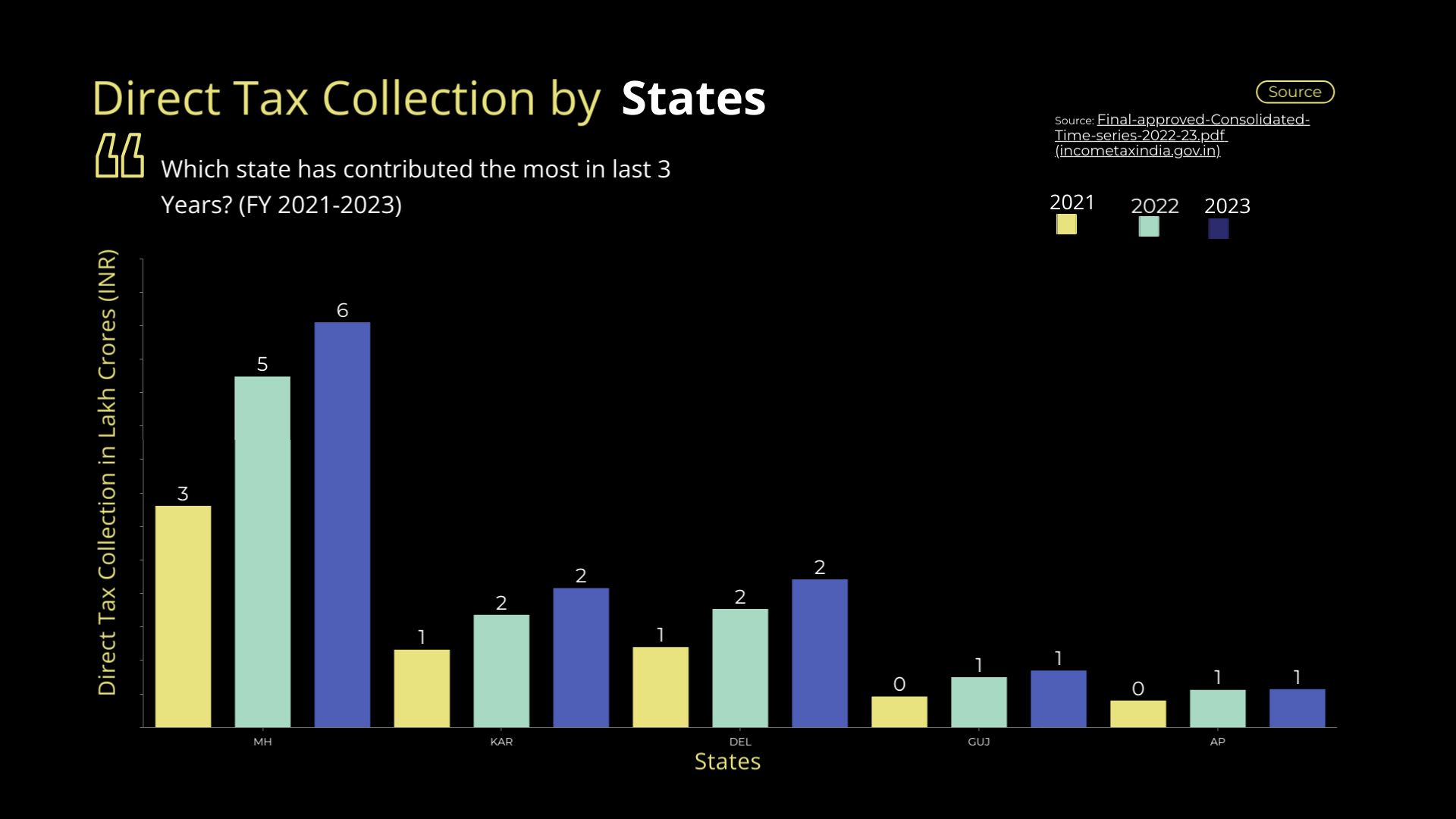

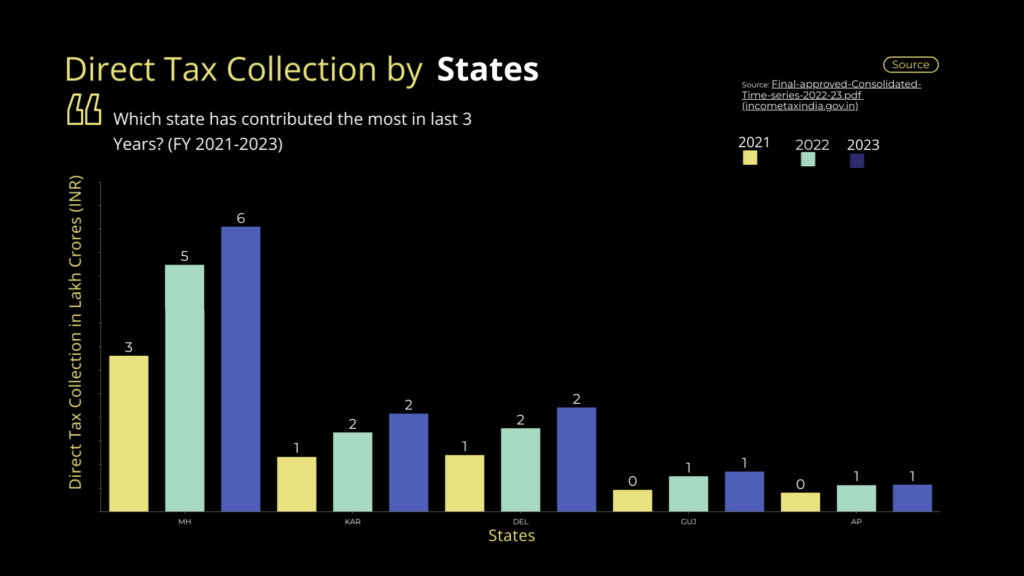

In this blog post, we will analyze the highest tax payer state-wise by different states in India over the last three years (2021-2023), based on the data from the Times series FY. The data is presented in the following chart:

Analysis of direct tax collection state-wise

- As we can see from the chart, Maharashtra (MH) stands out as the highest tax payer contributor, with a consistent increase in tax collection from 3 lakh crores INR in 2021 to 5 lakh crores INR in 2022, and peaking at 6 lakh crores INR in 2023.

- This steady growth underscores Maharashtra’s significant role in India’s economic landscape, as it is home to the financial capital Mumbai, the entertainment hub Bollywood, and several other industries and sectors.

- Karnataka (KA) and Delhi (DEL) have maintained a stable contribution over these years, with Karnataka contributing 2 lakh crores INR consistently and Delhi fluctuating between 1 and 2 lakh crores INR.

- These two states are also known for their vibrant and diverse economies, with Karnataka being a leader in information technology, biotechnology, and aerospace, and Delhi being the national capital and a hub for trade, commerce, and tourism.

- Gujarat (GUJ) and Andhra Pradesh (AP), on the other hand, have shown minimal contributions compared to other states. Their contributions have remained below or at 1 lakh crore INR throughout these years.

- This may be due to various factors, such as lower population, lower income levels, lower tax compliance, or higher tax exemptions. However, these states also have their own strengths and potentials, such as Gujarat’s industrial and agricultural sectors, and Andhra Pradesh’s natural resources and infrastructure.

This data is instrumental for policy makers, economists, and analysts to understand regional economic dynamics, enabling them to make informed decisions for resource allocation, policy formulation, and strategic planning to bolster national economic growth.

We hope you enjoyed this blog post and learned something new. You can also read about how many people in India pay taxes.

Please join our subscription list.

Thank you for reading!