India, with its staggering population, stands as one of the most populous countries globally. However, when it comes to paying direct taxes, the picture is quite different. Let’s delve into the numbers and explore how many Indians contribute to the nation’s tax revenue.

The Taxpayer Landscape

India’s tax system comprises both direct and indirect taxes. Direct taxes are levied directly on individuals and entities, while indirect taxes are collected through goods and services. In this blog, we focus on direct taxes, which include income tax, corporate tax, and wealth tax.

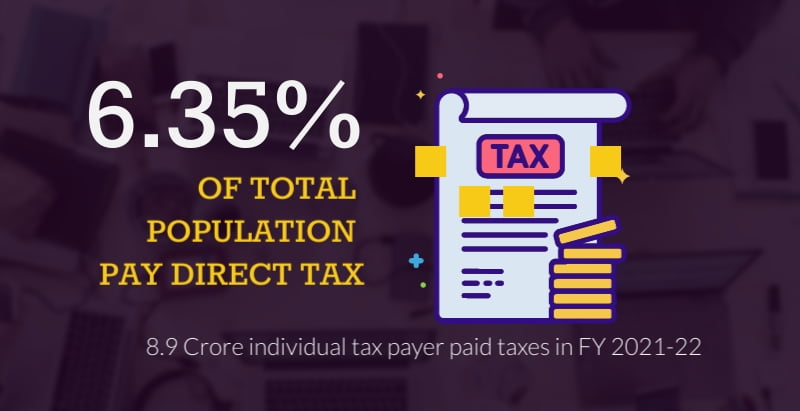

The Stark Reality

Out of India’s massive population of approximately 140 Crore, only a small fraction actively pays direct taxes. The percentage of taxpayers relative to the total population is alarmingly low—just 6.85%. This statistic raises critical questions about tax compliance and the burden borne by a select few.

Analyzing the Data

Key Observations:

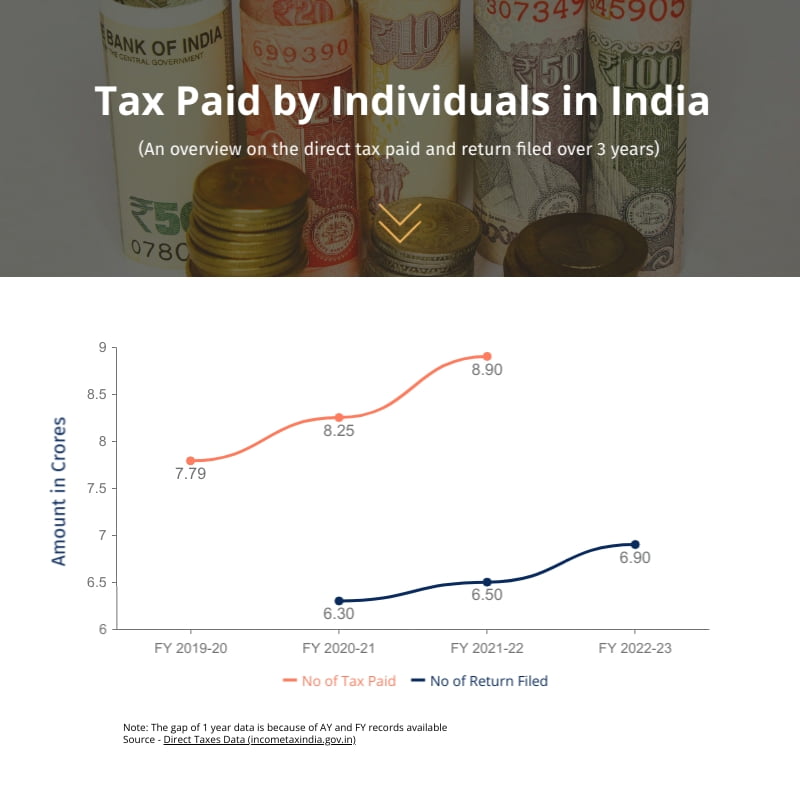

- Taxpayers vs. Return Filers:

- The number of taxpayers (those who actually pay taxes) is consistently higher than the number of return filers (those who file tax returns).

- This discrepancy suggests that some individuals may not be paying taxes despite filing returns.

- Incremental Growth:

- Over the years, the count of taxpayers has increased, albeit gradually.

- However, the growth rate is not commensurate with India’s population explosion.

- Challenges and Disparities:

- Several factors contribute to the low tax base:

- Informal Economy: A significant portion of India’s economy operates in the informal sector, where transactions often go unreported.

- Agricultural Income: Agricultural income is exempt from income tax, and a substantial rural population relies on agriculture.

- Tax Evasion: Tax evasion remains a challenge due to inadequate enforcement and awareness.

- Tax Compliance Culture: Cultivating a tax-compliant culture is essential for broadening the tax base.

- Several factors contribute to the low tax base:

Conclusion

India’s tax ecosystem needs a paradigm shift. While the government strives to widen the tax net, citizens must recognize their role in nation-building. Paying taxes isn’t just an obligation; it’s an investment in the country’s progress. Let’s work collectively to create a more equitable and responsible tax-paying community.