CRED has started the journey in 2018 as Credit card payment tech start-up; having simple concept to give you marketing benefit or affiliate benefits of brand offers and discounts based on the points you generate while making payment.

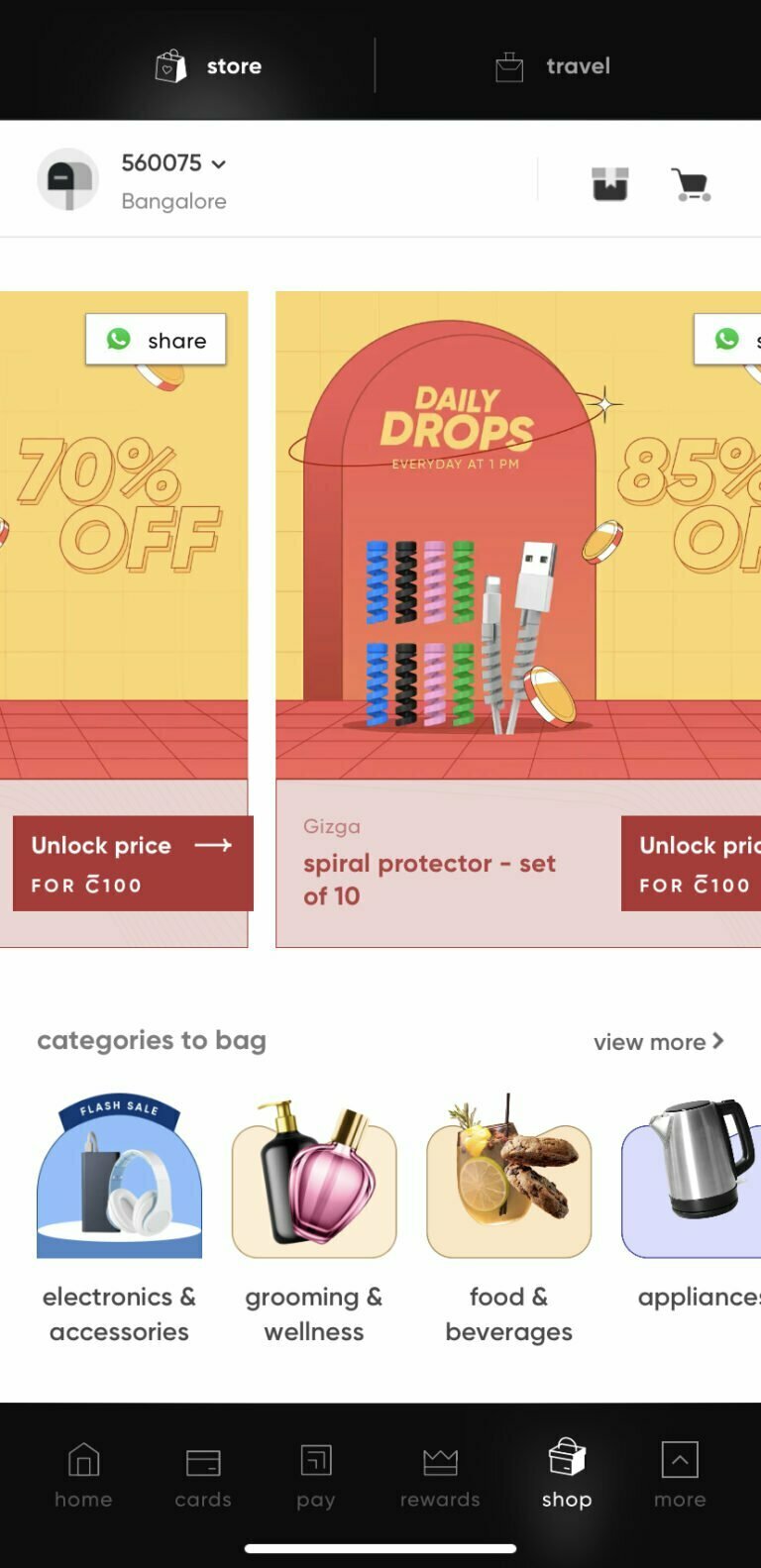

Now as on 2023, CRED has evolved as complete fin-tec company providing solution as wallet on various shopping apps to a quick loan as financing company. CRED has it’s own online store as well. I am using the App now over past 3 years (On and Off) and currently every month.

Now, let’s go to some trust factor of CRED App:

Trust X-Factor on Cred App -

The Founder

Till now, you must have heared his name once; Kunal Shah. He is one of the billionarie in India having history of creating successful start-up such as freecharge.com etc.

You can check out his complete profile.

The Advisors and Angels

Currently, CRED is backed up by the most prestigious investors as Lead Investors i.e. Sequoia Capital India, Stride Ventures etc.

The Business Partner

The Data

The User Interface

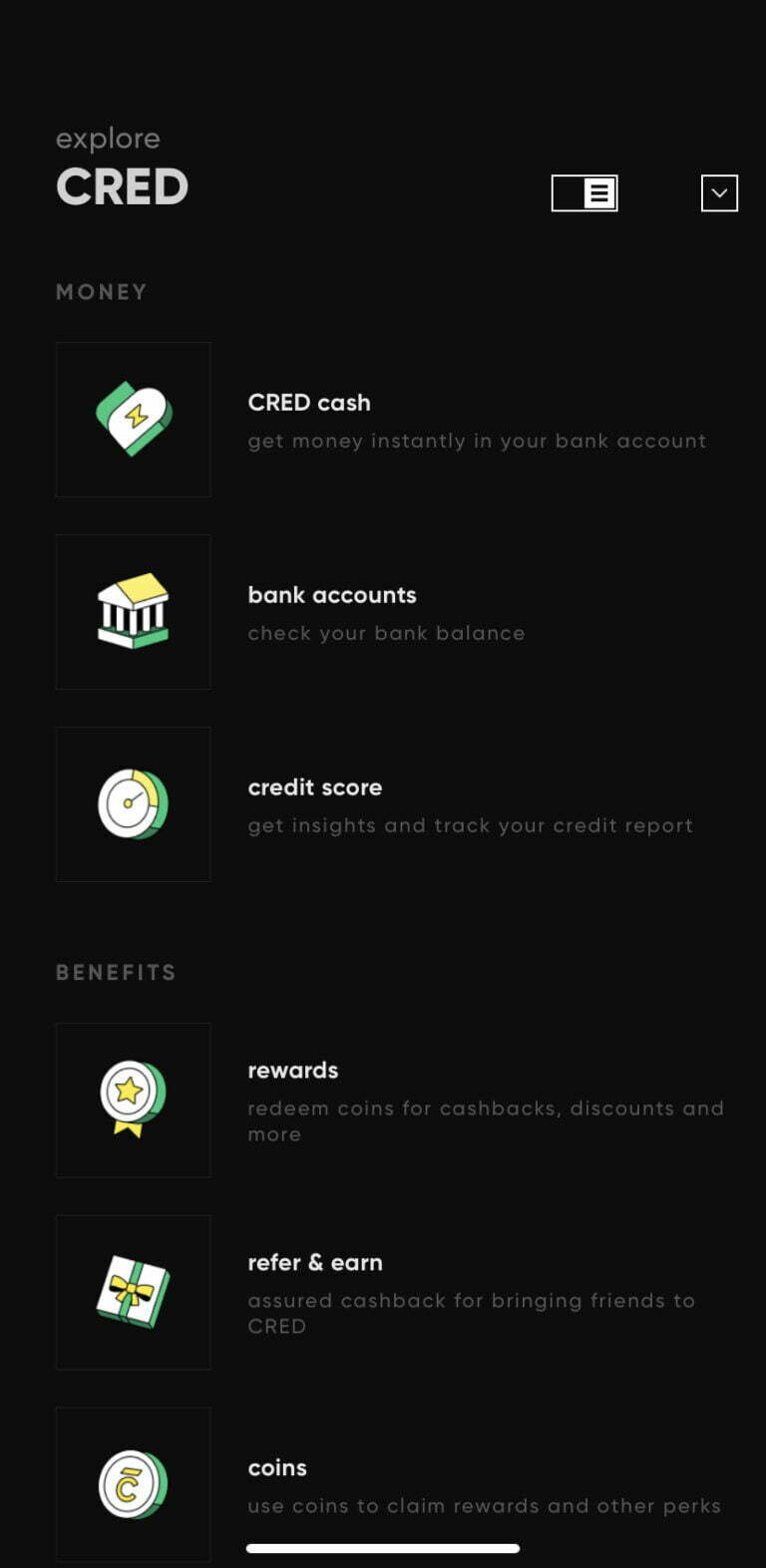

Yes, it’s not the best user friendly UI/UX design because of many options available and too many services/affilliate provided by CRED. It may be difficult for you in the initial 3-4 time of use to get hold on it.

Then, you will understand how everthing work.

You can click here to understand – Guide for Cred App

Value/Benefits to CRED Users

As on today May 2022, CRED provide following value added services to it’s User:

-To Check the credit score

-To Check the experia credit score

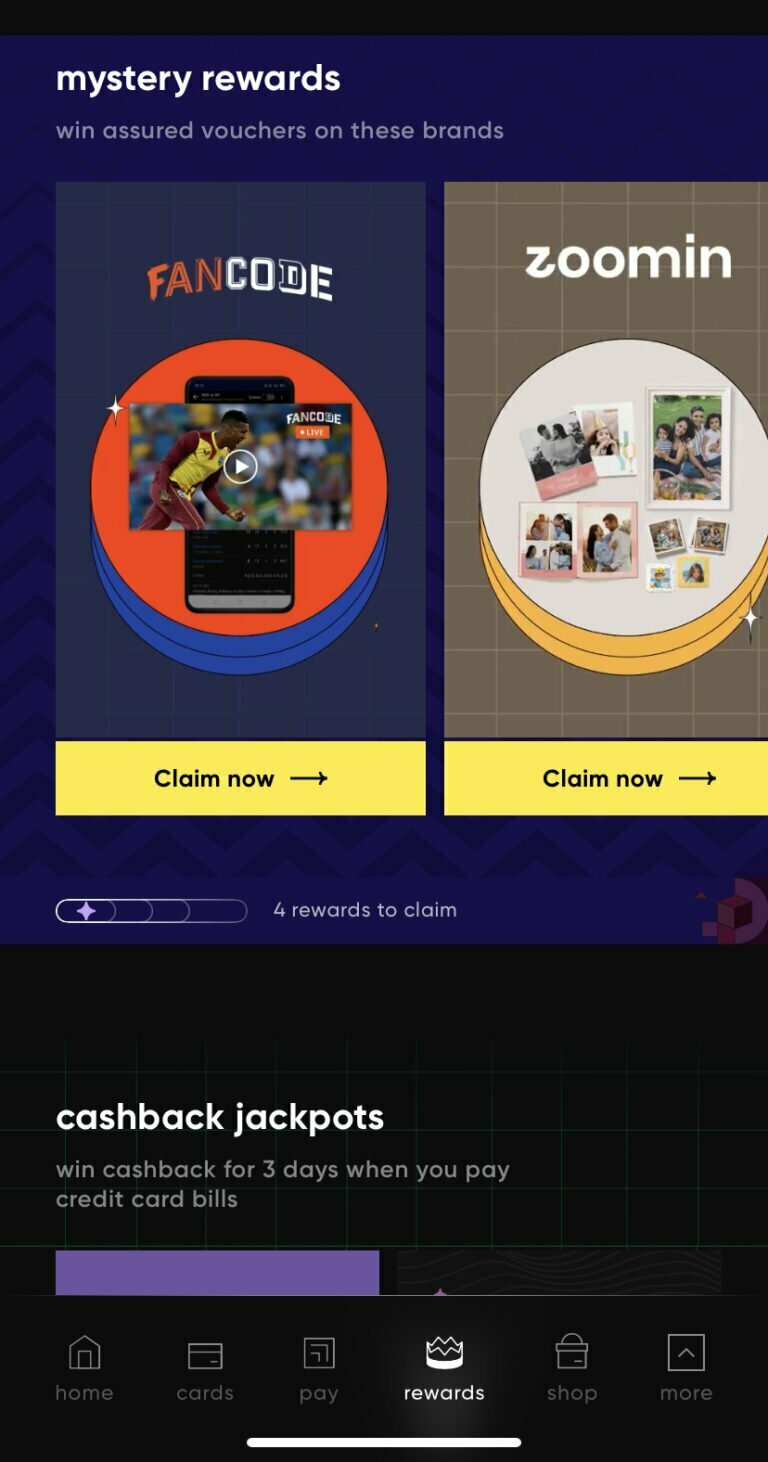

-Earn Discounts and Vouchers/Coupons

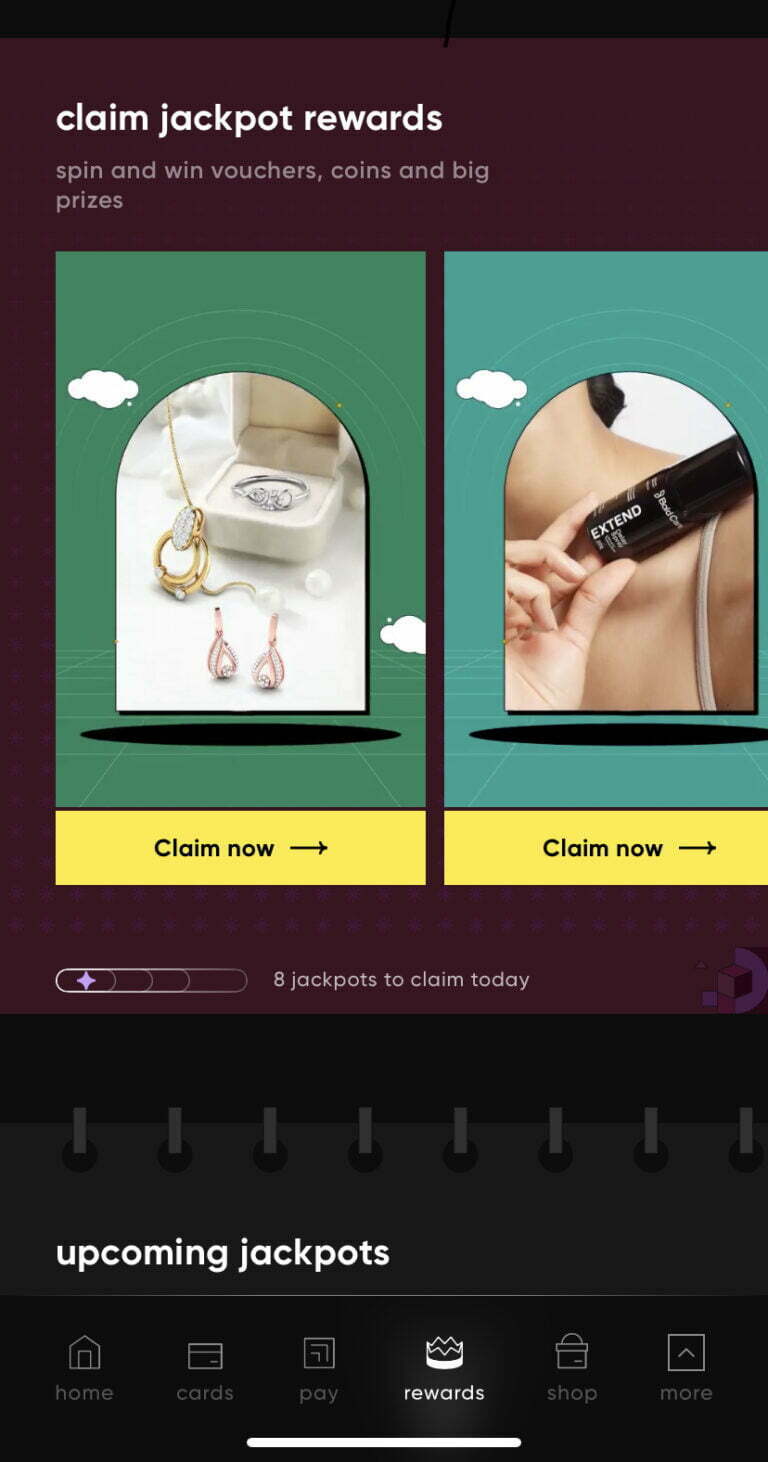

-Earn Jackpot on Spin

-Instant Loan based on credibility

-Utility Payment Such as Airtel, Electricity etc

-As A Wallet in other app linked to pay from your credit card

-Provides expense analysis

-Highlight any hidden charges

-Reminder for Credit Card Due Date

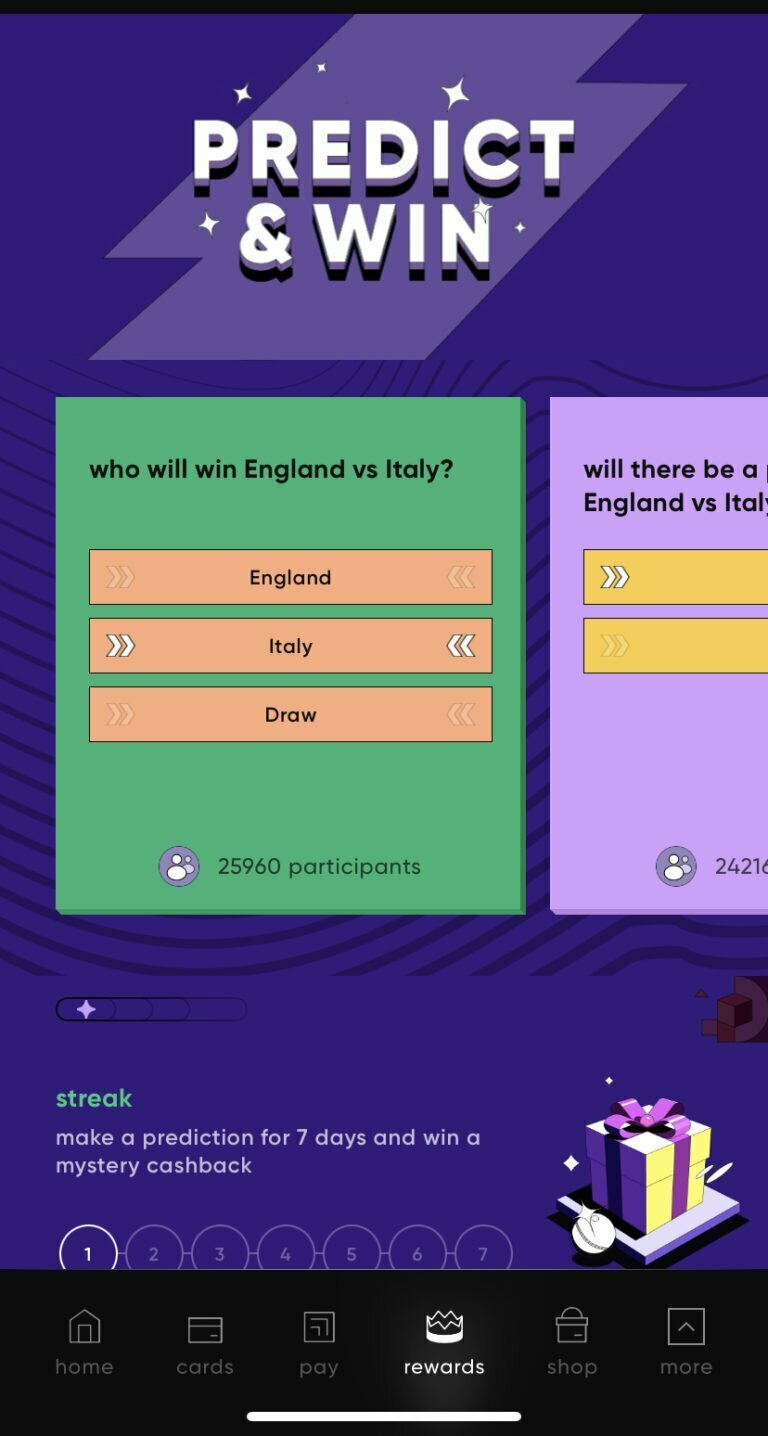

-Predict and Play for CRED Coins

The Review in App Store

The Average review in the Apple Store by the users is 4.8.

On and all My Personal Exprience

Initally in 2019/20, I started using the CRED but left it after a month or so because there was a time lag of 2 days in making payment through CRED and the real set-off balance by credit card company. Now in 2022, there is not a time lag of even 2 second as it’s almost the same as you pay your credit card through any bank.

Now, I saw many people comments that CRED doesn’t provide any beneficial user or useful voucher etc. The problem here is that you don’t have to even spend a penny and still you are getting several offers in hand to use and play a spin for jackpot.

Some of the best features, I love about CRED app is an instant statement review of expenses, instant Credit score, payment through app via credit card and instant CRED loan. And obviously, vouchers and offers.

Also, CRED is supporting all new upcoming brand and giving them good platform for marketing.

Now, Go Spin in CRED App and come back with jackpot for our next post !!

RECENT UPDATE

10th Feb 2023

CRED has booked a loss of INR 1,279 crores for the period April 2021 to March 2023. However, revenue is 4x at 422 crore for the said period.

10th June 2022

CRED raises $140M million which is equivalent to approximately INR 1,100 Crores for further expansions and growth.

09th June 2022

RBI has allowed to link UPI ID for credit card which will further expand the market share for CRED

FAQ's

CRED cash is an instant loan based on your credit score and past transactions in the app. It’s basically CRED loan provided to it’s user without any documentation instantly on clicks.

Yes, it’s completely safe to make payment through CRED App. I am doing it from last 2 years. Now, the payment is knock-off against outstanding as well instantly.

It depends on your need as the rewards are available on different domains such as travel, self care products and cloths, etc. Many times, the reward or voucher received are not substantial at all. Till now, I must have benefited approx. 3-4K in totality from CRED app rewards.

Through emails, you can reach out to CRED team for your queries and issues via

- grievanceofficer@cred.club

If you want to know other ways to reach out to CRED team; Click for CRED Customer Care Page.

CRED need your email access to import your credit card statement to analyze your expenditure for particular months.

It provides a good summary in different categories where you have swiped your credit card in a month.

In 2021, CRED already had 7.5 million user base paying credit card. This users are some of the most credible consumer; which makes easier for CRED to grow and successful in affiliate marketing.

Also, CRED is staying ahead of race by introducing new products for it’s users such as CRED Cash/CRED Instant loan, CRED UPI payment etc.