Groww app being one of the star player in the race with many new-age start-up to provide user friendly broker services to the millennials and Gen Z of India.

India still has only 1.2 crore active user only out of total population of 135 crore; which left out a lot of opportunities to all these new stock broker fintech start-ups Such as Zerodha, Kite, Upstock and Groww app as well.

Trust X-Factor on Groww App -

The Founder

All the founder in Groww start-up has come with strong experience in Flipkart.

The Advisors and Angels

Groww has been backed up all by all major VC such as Tiger Global, Sequoia Capital India, Propel Venture Partners etc.

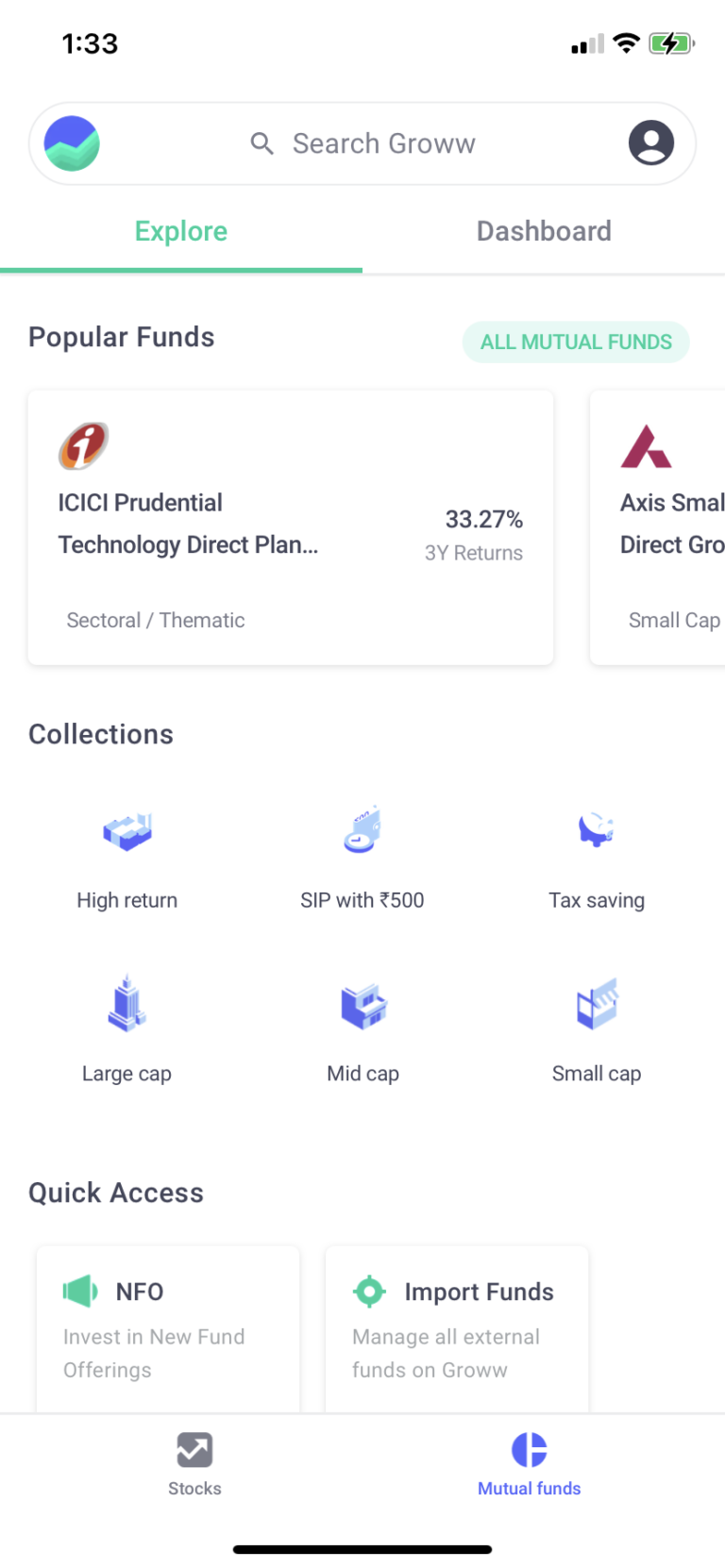

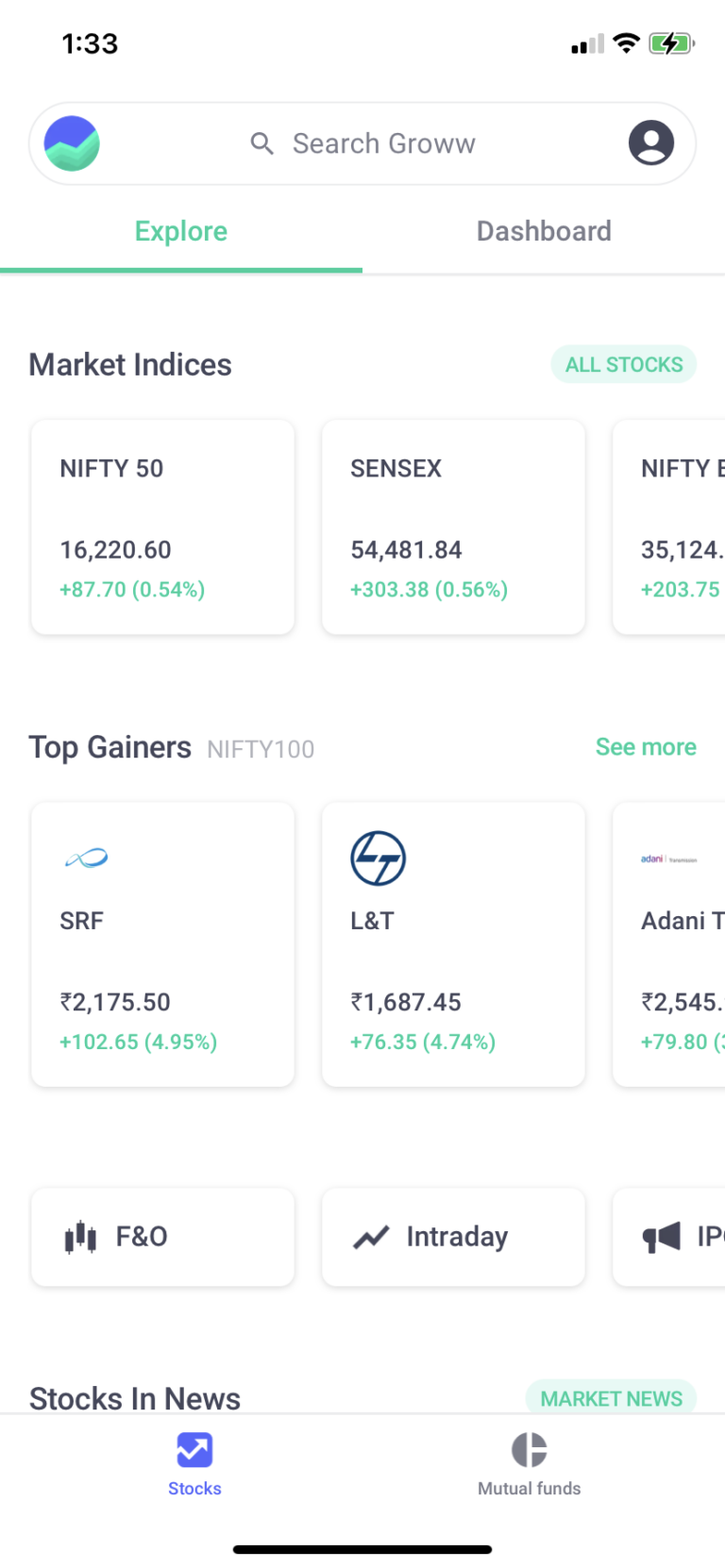

The Groww app User Interface

The UI/UX of the Groww app is seamless and fast. I am not an intra-day trader or regular trader; so I can’t comment or recommend for such user.

However, for weekly or regular investment or long-term investment purpose; the design of Groww app and dashboard is quite easy for understanding and quick outlook.

Moreover, Groww app is currently regular working on more updates on seamless experience for it’s user.

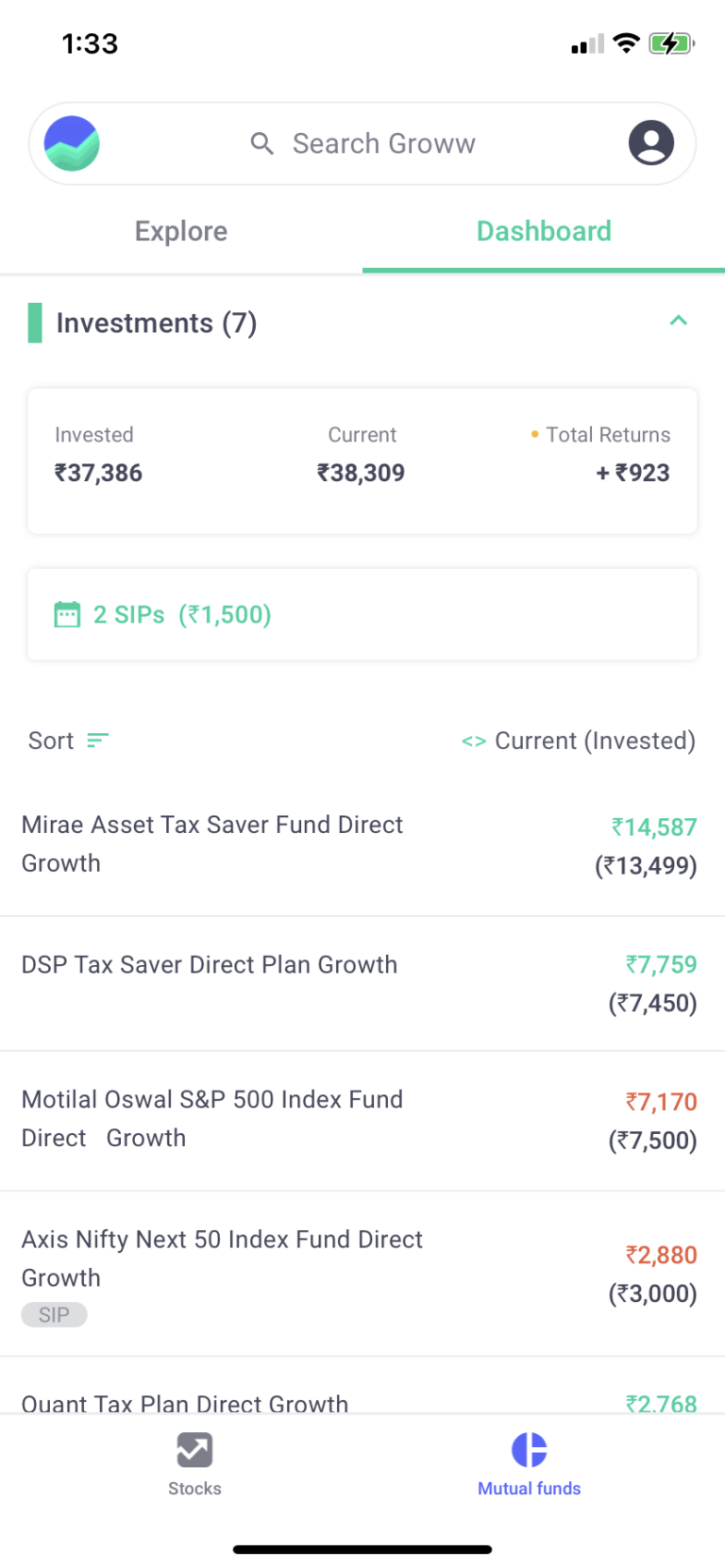

Currently in 2022, the Groww app is divided into two major section i.e Stock and Mutual Fund and further sub-divided into Explore (for search of stock and MF) and Dashboard (summary of your investment).

Value/Benefits to Groww app Users

Groww app has some of the additional features other than buy/sell of stocks and mutual funds; which creates that additional value to it’s user. Such as:

- dashboard of the current investment with several reports on simple clicks on summary

- unlimited watchlist creation for stock and mutual funds to track as per goal

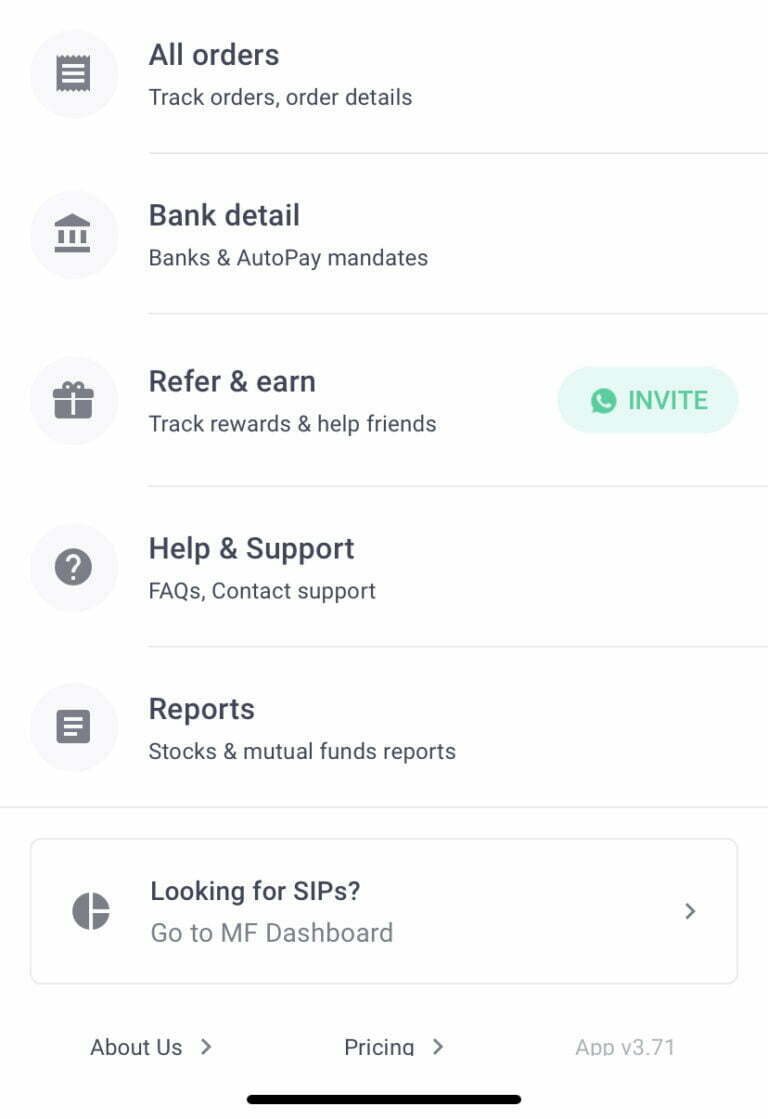

- several reports on request in Groww app

- easy investment with IPO and complete study about the company

- easy load of money for investment

- lower pricing of INR 20 or 0.05% per executed order for shares

- in-depth exploring option for shares and mutual funds on tip of click for all historical data

- Daily Groww Digest

The P&L Reports in Groww app

You can request P&L report of any period in excel or pdf from report section of Groww app. The report is very clear and there is no hidden charges by Groww app.

The Groww app Review in Apple Store

The Average review of Groww app in the Apple Store by the users in July 2022 is 4.4 (approx. 17k reviews)

On and all My Personal Exprience with Groww app

I start using Groww app from 2020. I stopped active investing in 2017 because of the losses I had before and lack of time to track investments from old-age broker platforms; which really felt like a consuming task.

In 2020, I saw one of my friend using the Groww app and it was so easy and so much on tip of my finger and clicking to invest as well to research on stocks and mutual funds.

In fact, I started my mutual fund investments from Groww app only for the first time.

For the growth of Investments, the most important part is gardening your investment regularly including for a long-term investment in this fast-pace economic and technology environment.

Groww app has been good tool for me to look out for my investments.

See you in next blog.

RECENT UPDATE

8th January 2022

Microsoft Indian-Origin CEO, Satya Nadella joins Groww app as investor and advisors.

25th October 2021

Groww app becomes $3 billion company in Series E Funding.

FAQ's

Groww app is backed up by some of the biggest venture capitalists and advisors and already quite established in India with more than 1 million users.

Therefore, it’s very less likely that it will vanish suddenly in one day. I am using Groww app now more than 2 years and trust the X-factors I have mentioned above in my blog.

Yes, Groww app is good for investment. Morever, It’s perfect for new-comers and long-term investment.

You can start SIP via 2 methods either auto-debit or by loading in Groww app wallet the SIP amount before the due date.

You have to go Explore section, select the mutual fund on which you want to start the SIP for investments and select the date on which you want to pay/debit the SIP every month.

Click on Place order. It will take unto 2 days by MF house to allocate the Unit in your Groww app account.

Firstly, you have to create a demat account by using PAN and Aadhar Card online with few clicks and seconds in Groww app.

Second, you have to link your bank account and verify it with Groww app account.

Third, Load some money on Groww wallet for investment.

Lastly, Go to Explore section, select the share you want to invest and enter the details to place order and it’s done. That easy it is.

Now, you can see your investments in dashboard of Groww app once the order is executed.

Nothing much, You only get INR 100 to invite your friends and family to open account in Groww app.

The refer and earn reward of the Groww app basically has zero value in terms of money.